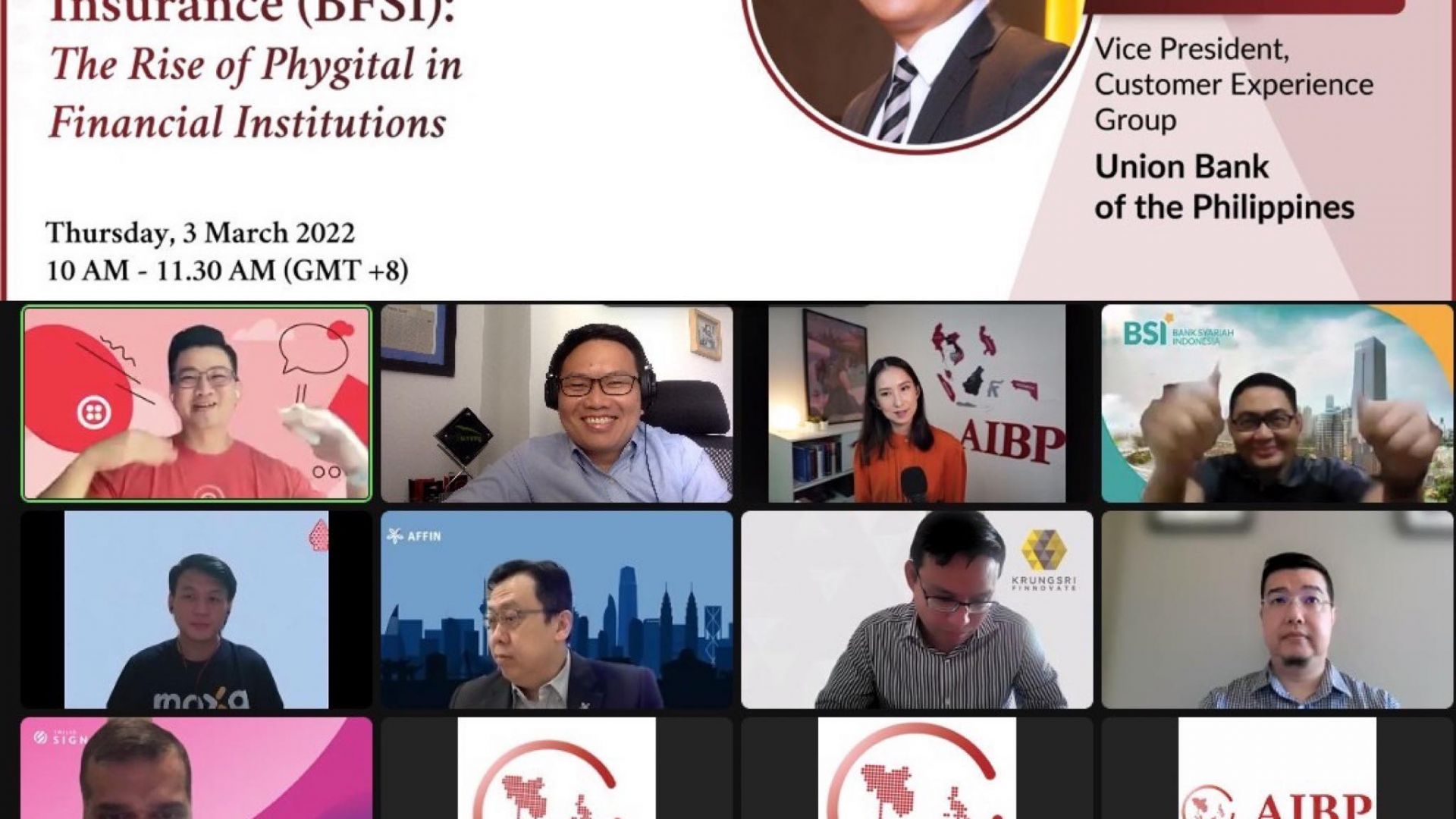

UnionBank CX officer talks on the rise of physical-digital hybrid bank branches at AIBP Insights 2022

Ron Batisan, CXG Physical Channels head, Union Bank of the Philippines (UnionBank), was among the panelists at the recently concluded AIBP Insights: The Digital Age in Banking, Financial Services and Insurance Forum. Among the topics discussed was the rise of PhyGital, a portmanteau of physical and digital, in financial institutions and how this is changing the way customers see the services provided to them.

The UnionBank executive talked about The ARK, the Bank’s award-winning, fully digital and paperless banking branch. “We did an experiment in one of our UnionBank’s branches in 2017. We digitized the transactions, the product applications. We empowered our people—calling them our branch ambassadors. We trained them not just to process transactions, but to engage with clients, to guide the customers on how to download our app, how to use the self-service machines, as well as handle digital conversion and advisory services,” Batisan said.

From just one, now there are more than 150 The ARKs all over the Philippines. Within the last four years, the Bank also saw a significant increase in the usage of self-service machines for cash and check deposits, cash withdrawal and other basic transactions, and in downloads for the UnionBank Online app, growing from about 300,000 users in 2017, to about 4 million to date.

“With that in mind, I think the role of our branch personnel have changed from transactional, to advisory and even selling. Now, they have time to sell insurance products, credit and debit cards, and other Bank products. They have become our sales and digital conversion team,” Batisan said.

Aside from the transformation of UnionBank’s spaces and people to meet the ever-changing needs of customers, essentially future-proofing the Bank, the cost of operating a physical branch was reduced significantly, contributing greatly to its bottom line.

“In 2020, we took a look at our network and saw that there were branches that had limited transactions but it didn’t mean that they didn’t have customers anymore. So, we rationalized and closed more than 10 branches then. But in terms of customer acquisition, we’ve gained a lot of customers especially through our digital account opening. For instance, we’ve opened more than one million accounts in 2021.”

With the ongoing changes in consumer behavior as a result of the accelerated shift to digital, Batisan said that financial solutions providers should continue to be at pace, introducing measures that will enable familiarity for customers, as they also explore new and emerging digital fronts, such as cryptocurrency and the metaverse.

“We should always operate in a sense that the path should still be safe with all of these new things that are happening,” Batisan said. “The basic concept of marketing should be considered, where we need to follow whatever is relevant to the customer.”